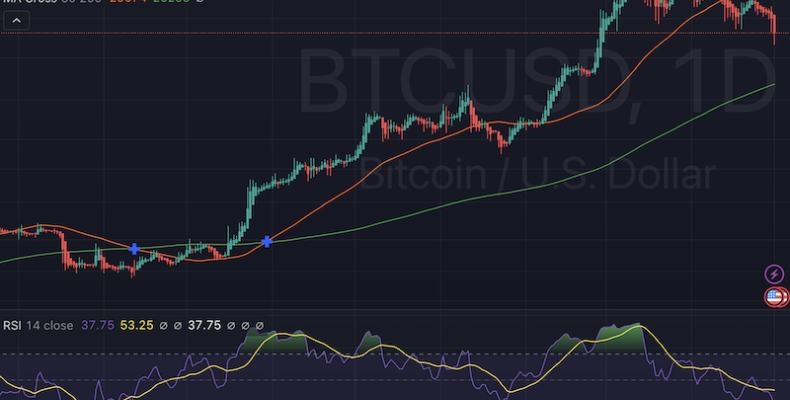

On May 1, 2024, the cryptocurrency market experienced a notable event as the price of Bitcoin plummeted below $57,000, marking one of the largest single-day drops in recent memory, with a decline of over 8%. Such volatility in the crypto space often presents challenges for investors and traders alike, requiring swift and strategic adjustments to navigate turbulent waters.

At Terramatris Crypto Hedge Fund, where we pride ourselves on our adaptive investment approach, we found ourselves in a position where proactive measures were necessary to safeguard our positions and optimize our portfolio amidst the market turmoil.

Here's a glimpse into the adjustments we made on this eventful day:

Rolled Forward Positions: Recognizing the need to extend our exposure while adjusting strike prices to align with the evolving market dynamics, we decided to roll forward a portion of our Bitcoin holdings. In total we rolled forward 0.33 put positions on Bitcoin with our total risk of $22,377.5 While rolling forward we also managed to decrease total position size to 0.28 put options on BTC with total capital at risk $17,345. Now thats some great risk exposure decrease in just one day! While rolling our positions (all in the month of May) we managed also to collect additional premium. In case of a sudden price bounce back, these might turn very profitable trades.

By carefully rebalancing and reallocating resources, we aimed to mitigate risk and preserve capital while seeking opportunities for growth.

While navigating volatile market conditions is never without its challenges, we at Terramatris remain committed to our investment principles of prudence, adaptability, and continuous improvement. By leveraging our expertise in risk management and market analysis, we strive to not only weather market storms but also capitalize on opportunities for long-term value creation.

As we reflect on the events of May 1, 2024, we are reminded of the inherent unpredictability of the cryptocurrency market and the importance of agility in response to rapid fluctuations. Moving forward, we remain vigilant in monitoring market trends, adjusting our strategies as needed, and maintaining a steadfast commitment to delivering optimal outcomes for our investors and clients.

In conclusion, while the recent downturn in Bitcoin's price may have rattled the market, it also served as a reminder of the resilience and adaptability required to succeed in the dynamic world of cryptocurrencies. Through strategic adjustments and prudent risk management, we stand poised to navigate the challenges ahead and seize opportunities for growth in the ever-evolving landscape of digital assets.

Now, besides that, we still believe that we might test $50,000 very soon